One of the few pandemic perks for workers has been the temporary break from traffic-congested commutes, but the lack of cars on the road has not been a stress-free experience for the automotive industry. As news of the coronavirus spread in March 2020, car sales plummeted, and the industry braced for disaster. Not only was it faced with the challenges of production, but also with a changing consumer mindset.

Navigating the twists and turns of 2020, Quantcast reviewed content consumption data to provide straight answers about the future of the automotive industry and new insights into the current car consumer.

You can download the full report here, or if you’d like a quick drive-through version, buckle your seatbelt for a preview.

Restarting the Automotive Industry

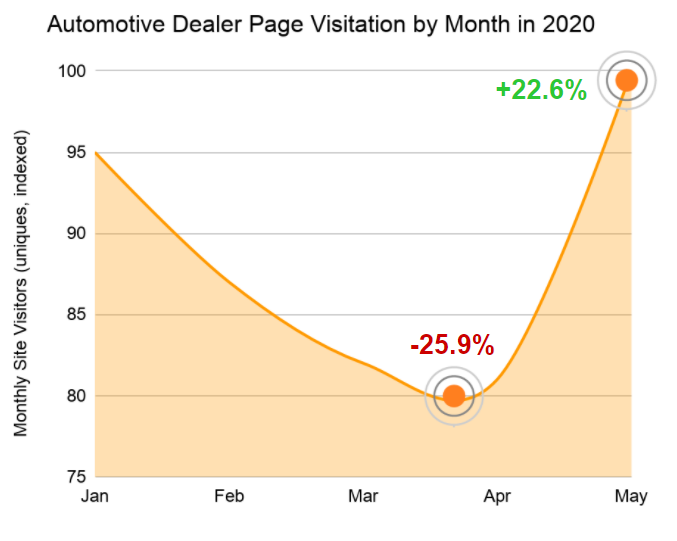

While January and February 2020 automotive sales started off strong, the pandemic sharply decreased car sales by -37% to -50% in March, resulting in Q1 losses for the major OEMs. Automotive websites also saw a stark decline in monthly visitation during March and April, down -10% from the start of 2020. Why shop for a car when you can’t even leave the house? Once restrictions started loosening in May, though, consumer interest revved up again: visits to automotive dealer sites were +22.6% higher than in April.

* Quantcast U.S. pixel data, automotive site traffic, Jan – Dec 2020

The Road to Recovery

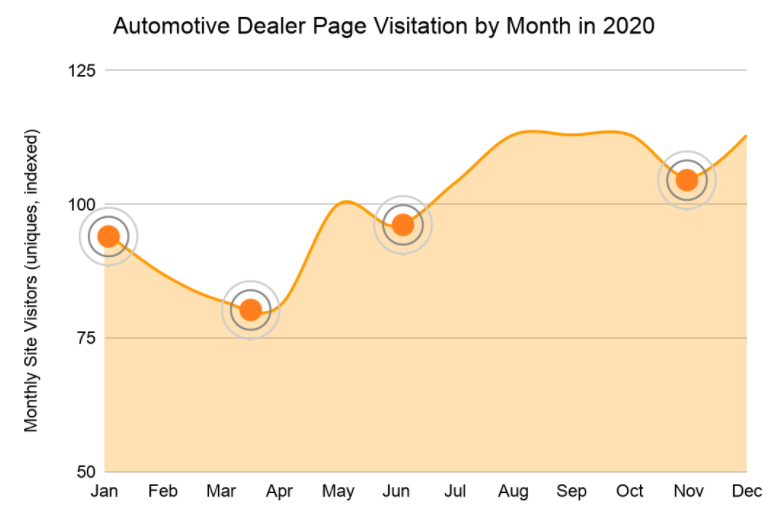

Zooming out, we can see that following this January to April 2020 dip, the road to recovery has for the most part remained steady: we saw additional interest dips in June and November, but they never turned to the low of 81 index points (19% down from yearly baselines) observed in April and remained higher, in fact, than the lows of January to March.

* Quantcast U.S. pixel data, automotive site traffic, Jan-Dec 2020

Is interest a predictor of car sales? Yes. In June, when the auto manufacturers announced that May car sales were up, observers concluded that this was the first sign of the automotive industry recovery. But the first sign, in fact, was consumer intent, as revealed in website traffic. Live data provides insights into shifting consumer behavior, allowing marketers to better position themselves to out-innovate their competition and win the race for new customers.

COVID Car Consumers

We see a shift in composition within the online car buying universe between work-from-home and essential workforces from pre-COVID-19 versus now. The largest gain in automotive research has been with consumers making under $50K and without a college degree.

Conversely, with so many affluent and middle-class Americans now working from home, their visitation to automotive sites has predictably dipped.

This shift likely reflects the position that non-affluent, blue-collar essential workers find themselves in: needing to commute to work, while hesitating to use public transportation. Car ownership, for them, is more necessary to get them safely to their jobs.

Driving Forward: New Opportunities

The pandemic has created a used car boom, becoming the strongest automotive segment and driving up the cost of used vehicles.

With public transportation and ride-sharing on the decline, 2020 saw first-time buyers entering the market, looking to used cars as an easy cost-entry point. This increased interest in used cars was further bolstered by traditional new car buyers, who considered certified pre-owned options (CPO) due to supply chain and manufacturing delays that reduced inventory for new car models.

June saw some of the greatest gains, with a 22% year-over-year increase in used car sales growth, becoming the highest monthly total since 2001. By October, this had impacted wholesale used car prices, resulting in a 15% YOY increase. Although prices have stabilized, they indicate the surge in demand.

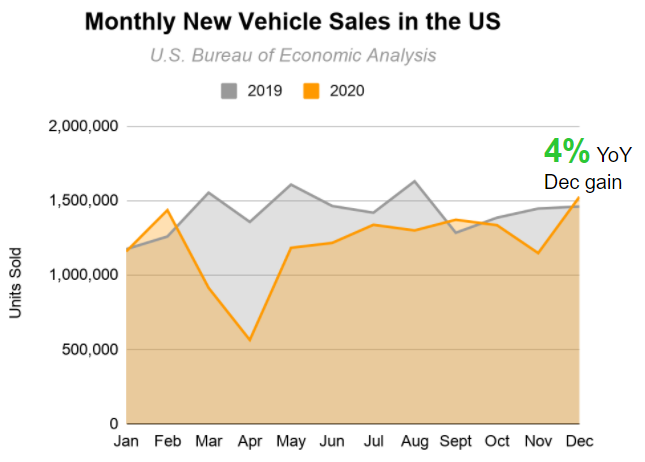

New car sales have also recovered. After dropping by almost 60% year-over-year in April, new car sales have made a dramatic recovery in recent months, even posting a 4% YOY gain in December.

* U.S. Bureau of Economic Analysis Data, Top Level Report: Overall Auto Industry Sales Figures, January 2021

Consumers are actively buying cars, so this is not the time for automotive marketers to go quiet. There is an opportunity to message the safety, comfort, and competitive benefits of a vehicle to capture market share.

Back to the Future

Over the last decade, the automotive industry has braced for their uncertain fate with Millennials, and more recently, Gen Z. Often opting to live in larger cities with numerous public transportation and rideshare options, Millennials have not seen car ownership as a step in adulthood. Gen Z has similarly scoffed at purchase, looking to the future of self-driving cars as a viable option. The biggest warning sign has been the large decrease in teens and twenty-somethings getting a driver’s license. In the last 35 years (between 1983 and 2018), 25% fewer 16-18-year-olds are licensed, reflecting the changing perceptions to this rite of passage between Gen X and Gen Z.

So will there even be a next generation of car buyers?

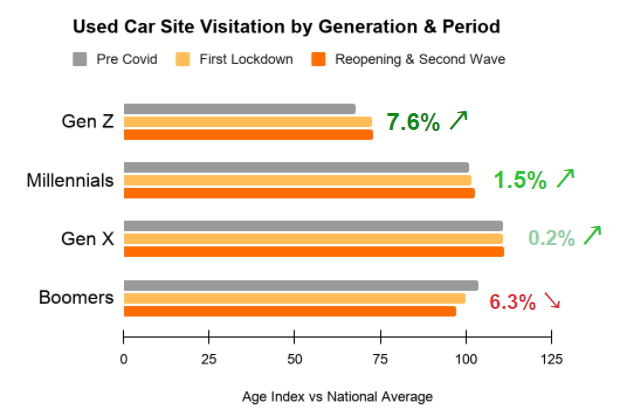

The pandemic has forced a change in behavior among Gen Z and Y. With ridesharing services and public transportation perceived as a less safe option, younger consumers who never considered a vehicle previously are looking to purchase a car.

Looking at Quantcast data for visitation to used car sites, comparing ‘pre-COVID’ and ‘reopening and second wave,” we saw a 7.6% increase with Gen Z and a 1.5% increase with Millennials. Conversely, we saw a 6.3% decrease with Baby Boomers. Likely due to the affordability factor, used cars are finding clear wins with younger audiences.

* Quantcast Measure, Jan-Dec 2020, U.S., used car buying and selling audience browsing content. Periods: Pre-COVID (Jan 1-Mar 12, 2020), First Lockdown (Mar 13-May 31, 2020), Reopening & Second Wave (Jun 1-Dec 31, 2020)

Adapting to the challenges of the last year, the automotive industry continues to rebound, fueled by a shifting demographic of car consumers, ready to drive forward new sales.

Want to Stay on Track with the Right Audiences?

For a more in-depth picture of automotive consumer trends, check out our data insights page and download our full 2021 US Automotive Insights Report. To see how Quantcast is helping other automotive brands grow their audiences, see our case studies with ARB 4×4 accessories, Fiat Chrysler, and Youi automotive insurance.